Warehousing and the Golden Logistics Triangle

The COVID-19 pandemic accelerated the steady growth in online sales, reaching a peak of 38% of retail sales in 2021. Data published by the Office for National Statistics showed that clothing and household goods were the most common items bought online in 2020. This, and the introduction of same day delivery by companies such as Amazon and Next, has led to an increase in demand for warehouse space.

New warehouse construction orders amounted to over 5 billion pounds worth in 2021 which was a record high since 1985. The number of premises used for logistics, warehousing and transport purposes has doubled within the last decade which was accelerated by the pandemic and Brexit. This has contributed towards the growth and demand of space in the UK’s Golden Logistics Triangle, and other areas.

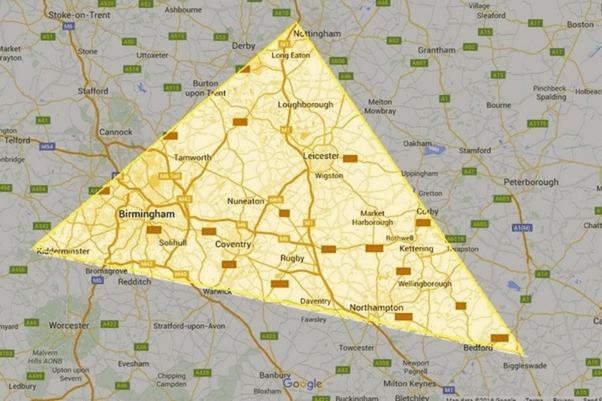

Golden Logistics Triangle

The Golden Logistics Triangle is an area of the Midlands comprising of around 289 square miles that is renowned for its high density of distribution facilities. Being within a 4-hour drive of 90% of the UK population, its easily accessible by the M1, M6 and M42 motorways, making it a prime location. It originated in the late 1980s and initially covered an area around Magna Park in Lutterworth however this has grown significantly to what it is today. A vaguely defined area, people have varied interpretations of the triangle, but it is generally seen to encompass Nottingham, Birmingham, and a large stretch of the M1 down to Northampton.

With the heightened demands placed on retailers, it has become more important to keep up with quick delivery times in order to maintain a competitive edge within the industry. Being located within the Golden Logistics Triangle gives businesses the capacity to replenish stores more rapidly, focusing on the customer experience and maximising sales. There is currently estimated to be around 150 million square feet of warehouse space in the Midlands, home to retailers such as Marks & Spencer, Disney, Asda, and Tesco.

The high demand for space within this area comes with consequences. Rent prices have increased and with current escalation of energy prices alongside the cost of living leading to labour price issues, there are several obstacles and difficulties for those wanting to invest in the region. Many retailers are beginning to look elsewhere, with the M40 being a strong contender as it avoids majority of the issues associated with the Golden Triangle.

Providing easy access to central London, the M40 has accessibility and comparatively low congestion. Recent investment in new housing around the area has led to potential influx of workers which would be promising for new developments. Additionally, the M62 is seeing a great deal of investment, providing similar opportunities in the North West and further connections.

It seems the popularity of the Golden Triangle is causing it to expand and so businesses are looking further afield with mid-size warehouses to better accommodate nationwide demand.

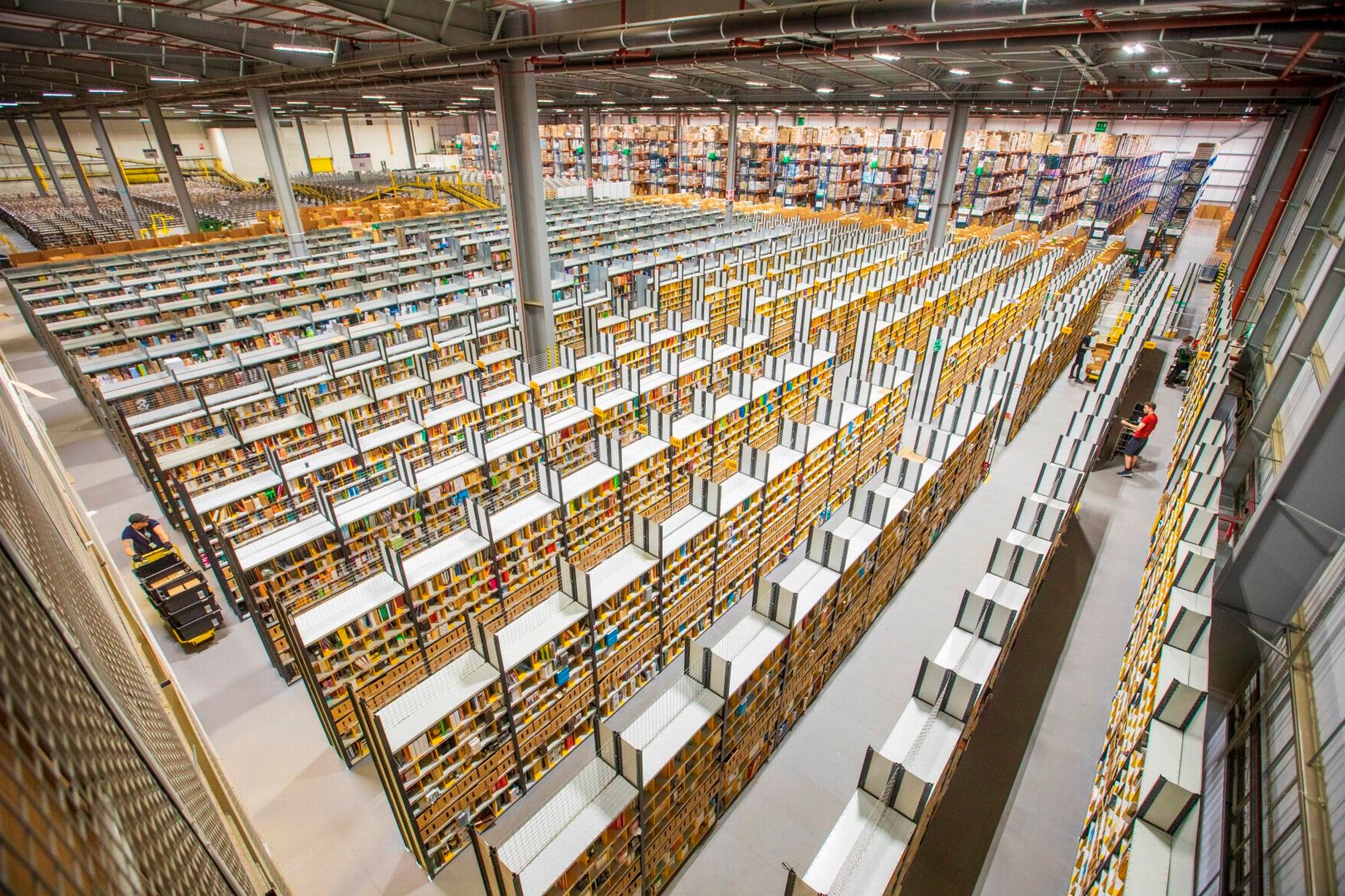

Warehousing Growth

A report by Savills concluded that the biggest warehouse space growth came from online retailers who have increased their warehouse space by 614%. Other sectors that have benefitted from the growth of online sales are the wholesale and parcel sectors. They have increased their use of warehouse space by 73% and 51% respectively and saw increases in the second-hand market.

The overall size and scale of warehouses has grown since 2015. Units over 1m sq ft have seen an increase in numbers and currently account for 9% of stock. The increased popularity of larger warehouse units means the average size of units has increased up to 340,000 sq ft.

The warehousing sector has been instrumental in supporting the growth from online retailers and has supplied thousands of new jobs. It will continue to be under pressure throughout the economic recovery from the pandemic as online shopping continues to grow and manufacturers continue to look for space.

Predicted growth suggests that online shopping will make up 35% of all retail by 2025, and the pressure will be on retailers to meet consumer demand for home deliveries. With this in mind, more distribution and warehousing facilities will be needed but growth may be constricted due to rising costs, shortage of land and the economic impact of the pandemic and Brexit.

Our Industrial and Logistics divisions constantly have new roles available so get in touch if you're looking for work!